The global shipping giant Maersk, which attempted to return to the Red Sea, was attacked over the past weekend and was forced to suspend its resumption plan for two days. However, according to the latest shipping schedule released by Maersk, dozens of container ships will still pass through the Suez Canal.

The decision is based on the fact that the escort alliance led by the United States has completed its deployment, and the congestion of the canal has caused a significant impact on global trade. At present, domestic terminals have experienced blank sailings, and the China-Europe block trains as an alternative have been fully booked in advance.

Shipping giant restarts

According to the official news released by Maersk on December 31, 2023, as the first batch of ships returning to the Red Sea, the “Maersk Hangzhou” was hit by an unidentified object on the evening of December 30 while passing through the Strait of Mandeb from Singapore to the Port of Suez in Egypt. After the initial attack on the ship, four ships approached the “Maersk Hangzhou” and opened fire in an attempt to board. The security team on the ship and a helicopter deployed by a nearby navy vessel jointly repelled their boarding attempt.

At present, the crew on the “Maersk Hangzhou” is safe. In view of this incident, and to allow time to investigate the details of the incident to further assess the security situation, Maersk decided on December 31, 2023, to suspend sailing through the region for the next 48 hours.

Just a week ago, with the implementation of the “Operation Prosperous Guardian” initiative participated by multiple countries, the team had just started to prepare to restore the east-west (Asia-Europe) route through the Red Sea, and formulated a plan for the first batch of ships to pass as soon as possible, “This is the most welcome news for the entire industry and the operation of global trade.” However, the official pointed out that it is worth noting that the overall risk in the region has not been eliminated at this stage. The primary task of the shipping company is always to ensure the safety of the crew, ships, and customer goods, so once safety is threatened, it will immediately reassess the situation and restart the detour plan.

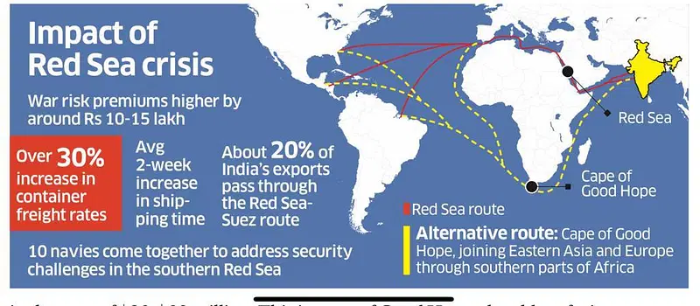

To avoid risks, several international shipping companies have previously made decisions to suspend shipping or detour. Maersk first announced the suspension of the Red Sea, and then planned to let all ships that are suspended and passing through the Red Sea detour around Africa via the Cape of Good Hope. Recently, Maersk’s resumption plan was forced to be suspended, and then continued to restart, which is regarded by the industry as affecting the subsequent decisions of other companies.

According to the shipping schedule released by Maersk on the evening of January 1, 2024, dozens of container ships on the Asia-Europe route, the Middle East route, and the trans-Pacific route will continue to pass through the Suez Canal. Among them, the flights that decided to continue through the Suez Canal include ships that left the port after December 31, and some ships that departed in mid-to-late December and will arrive at the port in early January.

With the completion of the escort alliance led by the United States, in addition to Maersk, French CMA CGM also announced its return to the Red Sea route.

Blank sailings appear, freight rates continue to rise

Affected by the still unstable situation in the Red Sea, a series of effects are emerging.

“At present, there have been blank sailings on the routes in Europe and the Middle East.” Wang Zhicong, director of the marketing department of Shenzhen Bosen San Tong Logistics Co., Ltd., told First Finance that according to the big ship schedule of the European route of Yantian Port, Shenzhen in January 2024, January 8, January 15, January 17, January 18, January 22, and January 25 all have blank sailings. Blank sailing means that the big ship cannot dock at the domestic port, which means that there is no cabin available for freight forwarders and foreign trade companies.

The international logistics platform Flexport believes that the Red Sea crisis will trigger a series of chain reactions, especially in terms of containers, it is expected that there will be a shortage of containers and port congestion. The shortage of empty boxes may spread to Asian ports as soon as mid-to-late January. Although the shipping industry has enough containers, they may not be in the right place. The empty boxes needed for China’s export peak season may be trapped elsewhere. Ships in the Asian region will also face challenges in the availability of empty boxes.

In addition to the earlier-than-expected appearance of blank sailings, price increases are also inevitable. “All routes are rising in price, and the shipping company’s prices are one price a week, and the prices are still fluctuating.” In addition to the price increase, Wang Zhicong said that the market occasionally flows out of ultra-low prices, such abnormal fluctuations make some customers have to choose to continue to wait and see.

The data shared by Wang Zhicong shows that the quotation for the European route in the first week of January (starting from the 1st) has risen to 4200 US dollars (40-foot container, the same below), and the second week (starting from the 8th) has further risen to 5200 US dollars. The freight rate for the US line will also increase by 1000 US dollars on January 1, with the West Coast rising to 3000 US dollars and the East Coast rising to about 4000 US dollars.

According to the report released by the Shanghai Shipping Exchange on December 29, 2023, from December 25 to December 29 of the week, the Chinese export container transportation market continued to be tested by geopolitical risks, and the market freight rates for routes such as Asia and Europe continued to rise, driving the composite index to rise sharply. European route, the tense situation in the Red Sea is still continuing. At present, there are major differences in the shipping market, and commercial shipping from the Red Sea to the Suez Canal will face great uncertainty due to geopolitical tensions in the future. In terms of freight rates, affected by the tense situation in the Red Sea, the market freight rates for North American routes, Persian Gulf routes, etc. will continue to rise across the board.

Not only container ships, but also the prices of dry bulk shipping transporting bulk commodities are rising.

Wang Yanping, chairman and president of the dry bulk shipping company Guohang Ocean Group, told First Finance that the Baltic (BDI) index has seen a significant increase since the third quarter of 2023, mainly benefiting from the increase in US grain exports and the demand for bulk commodities in Asian countries including China. At the same time, the congestion of the Panama Canal and the conflict in the Red Sea further catalyzed the rise in freight rates. The uncertainty of geopolitics in 2023 and climate change causing canal congestion, these black swans will continue to affect the shipping industry in 2024, “the expectation of the upward shift of freight rates in 2024 and the imbalance of supply and demand will exist for a period of time.”

“Like the price increase of containers, the freight rate of the bulk market has also directly risen.” Gao Xuefeng, general manager of Mavega Group in China, a global ship brokerage company, told First Finance that the income of shipping companies will fluctuate with the market and be positively correlated with freight rate trends, and the business volume is also expected to increase. As for the changes in the prices of bulk commodities, it depends on the supply-demand relationship, and of course the extension of the shipping distance will inevitably bring impacts.

Wang Yanping pointed out that according to Clarkson’s forecast data, the growth of dry bulk transport capacity in 2024 is only 1.8%. At the same time, due to the new regulations of IMO (International Maritime Organization) and the requirements of the EU carbon tax, old ships are facing technical modifications or elimination, coupled with the full load of shipyard orders, the shipyard that can build dry bulk ships is limited, and there may be a decrease in effective transport capacity in the future. In general, the supply-demand relationship will further improve in 2024, and the dry bulk shipping market has upward elasticity. It is expected that the supply-demand fundamentals will continue to improve from 2024 to 2025, and the medium and long-term outlook is good for the rise in the central freight rate, and the dry bulk shipping industry has entered the supply-demand reversal stage.

China-Europe block trains are fully booked in advance and prices rise

As the New Year holidays of European and American customers gradually end, more effects are waiting to be upgraded.

As one of the alternatives to sea transportation, the cabins of the China-Europe block trains have been fully booked in advance. Chen Kaifeng, director of business development of Yixinou, told First Finance that European customers were still on holiday a while ago, and some have not yet reflected on freight. At present, the railway freight cabins in January have been fully booked, “as if all the goods were received before New Year’s Day”, just waiting to be loaded. And usually, customers usually book cabins 2 weeks in advance. At the same time, the freight rate in January has risen by 10% to 20% month-on-month, and it is rising step by step with the market.

According to the cycle of foreign trade, after the peak shipping season in October, January of the New Year is also a small peak season, and Chinese suppliers will rush to complete shipments before the Chinese Spring Festival in February.